Chip Baker is a man of many pursuits and accomplishments in the cannabis industry: he is the founder and former owner of Royal Gold Potting Soil, the founder and current CEO of Cultivate Colorado, and he is also the host of his own cannabis industry podcast — The Real Dirt with Chip Baker.

In this Ganjapreneur.com Podcast episode, Chip sits down with our own podcast host TG Branfalt to discuss Chip’s entrance to the cannabis world, the early years he spent learning about cannabis cultivation from professionals in Switzerland and the Netherlands, and the important role that independent media plays in the national coverage of the cannabis movement.

Listen to the podcast below, or continue scrolling down to read a full transcript of this week’s episode.

Subscribe to the Ganjapreneur podcast on iTunes, Stitcher, SoundCloud or Google Play.

Listen to the podcast:

Read the transcript:

TG Branfalt: Hey there. I’m TG Branfalt. You are listening to the Ganjapreneur.com Podcast. The Ganjapreneur.com Podcast gives us an opportunity to speak directly with entrepreneur and experts working on front lines of the industry to normalize cannabis to responsible business, education, and activism. As your host, I will do my best to bring you actual information to help you plan, grow, and manage your cannabis business. Today, I’m joined by Chip Baker. He is the host of The Real Dirt with Chip Baker, founder and former owner of Royal Gold Potting Soil, and founder and owner of Cultivate Colorado. How you doing today, Chip?

Chip Baker: Oh, I’m doing great, Tim. Thanks for having me on. I’ve been looking forward to this all week.

TG Branfalt: No doubt, no doubt. We’re on the heels of Sessions coming out saying that he’s probably not going to make a whole lot of changes to the Cole Memo. So that’s kind of some good news that we’ve had in the last week, after a couple of weeks of just kind of being shamed by the administration.

Chip Baker: Right, right. Yeah, it’s a tough political world right now. There’s so many uncertainties. The cannabis industry really is an uncertain industry, but honestly it has more security today than its ever had. Most people that want to be involved in a legal cannabis industry aren’t going to jail.

TG Branfalt: I mean, aside from what did happen with Canada with Mark and Jody Emery, but we’re already getting off topic here. I want to thank for being on the show. So why don’t you tell us about your background, how you’d get involved in the cannabis space, and tell me more about your time in Europe.

Chip Baker: Well, man brief history. I was raised in Georgia, always been interested in farming and agriculture, agriculture technology. When we were kids smoking weed, we just had joints, or didn’t necessarily know what it was. Lots of drug war propaganda back there. And we got a sack one day that had seeds in it. To this day, when I see those friends that were involved in it, they quote me by saying, “We can grow this shit.” That’s what fascinated with me of cannabis. It was this incredible, psychedelic plant with, you know, lots of potential medicinal value. And we can grow it. We can grow it ourselves. That’s really where it all started way, way, way, way long time ago. Right.

I kind of started out early, probably earlier than most people should. But fascinated with growing things. One thing led to the next, and I ended up in University of Georgia studying botany, and then, Biological Anthropology, basically the pre-history of agriculture, the archeology of agriculture. And that just kind of set the tone for my life. In ’97, we moved to California, me and my then girlfriend, and now wife to be involved in the medical cannabis industry, and immediately hit with a great group of people, great group of activists that were really pushing the limits. Some of them had been growing weed for 30 years already, and really got a great knowledge then. And had a number of successful years experimenting, and growing different cannabis in different ways up in Humoldt county, at the time the epicenter of cannabis in the world, really.

But there was only one place that was doing it legal, and that was in Europe, The Netherlands. At the same time, the Internet had come about, this crazy thing that we take advantage of, and we’re having a Skype interview on right now. And I was able to communicate with people oversees, and say, “Hey man. I’m from Humboldt County. I live in Humboldt County. You know, we’ve got this strain, or this technique, or I have this interesting question.” It just opened a lot of doors for me. We went over there first in, I think, 1999, and met everybody, Sensei Seeds, and Mr. Nice, DNA Genetics, Segmarta Genetics, all of those early people, and stayed there for a number of years on and off, specifically in Switzerland with Scott Blakely of Mr. Nice Spain.

At the time, he was growing acres, and acres, and acres, and acres, and acres of weed. Greenhouse, light dep, indoor. And I was able to spend about a year and half on and off there with Scott. And he really schooled me in several different ways, and allowed me to go, and take pictures, and ask questions all throughout Switzerland and where he was growing these massive, massive cannabis crops. That was 2000 to 2002, 2003 I believe. All that got shut down. And it hasn’t really been until recently that these massive style grows have really come back. It’s kind of a brief overview of what’s happened in the past 15 years, but that’s where we’re at. Now, we’re having these huge grows again, 1,000 lights, 1,500 lights, huge greenhouse operations, 20,000 50,000 square feet, you know, 5 acres of greenhouse, 10 acres of greenhouse all over Colorado, California, Oregon, Washington. It’s really a great time to be involved in the cannabis industry, that’s for sure.

TG Branfalt: So why don’t you tell me about some of the growing techniques that you picked up in Switzerland.

Chip Baker: Well, light deprivation is the primary thing that we picked up in Switzerland. At the time, in northern California, every one called it Black Box. And there was all kinds of, like, misnomers on how it worked, and what you did, that people basically taking black sheets of plastic and pulling it over their plants in some manner; anything that’s kind of poor quality cannabis.

Well, so Scott, he had perfected this technique. He had been studying with rose growers and cut flower growers on how to control your nighttime and daytime temperatures, and simple light deprivation operations. Now, what light deprivation is it’s where you artificially control your nighttime in a greenhouse, or an outdoor setting. So, you black the plants out for 12 hours a day to induce flowering anytime of year.

Linus, one of our founders of modern botany, he developed this technique 150 years ago. Right, and I had tried it. I’d been using it and trying it for a number of years, but it wasn’t until I saw the techniques they were using, which were supplemental lighting to keep your vegetative plants going. This idea that there was every moment of the day, every moment of sunshine was flower time, instead of having these traditional, seasonal flowering periods. That was new to me. You know, over there Scott was literally flowering every single day. Mr. Nice, GBT Genetics, they were flowering every single day of the year, and just using high-pressure sodium lights at the time, 400 watt lights to supplement the light to extend their daylight, increase their vegetative period say in the winter time. Or to use an extra light in the winter time to increase the light intensity in the greenhouse. These guys really liked growing incredible, indoor quality cannabis, what at the time was perceived an inferior technique to grow weed.

TG Branfalt: And you described yourself to me earlier as a soil guy. Um-

Chip Baker: Yeah, dirt.

TG Branfalt: Dirt. Tell me about your soil, and how it differentiates from others out there, and how you came up with the recipe, so to speak.

Chip Baker: Sure. Well, I founded Royal Gold Potting Soil in 2002 or 4. It’s been such a long time ago, I’ve kind of forgotten. And I sold it just recently last year to my partner and a group of investors. And we still happily do business together. I’ve always wanted to make my own soil, and been fascinated with soil biology and soil chemistry. So, I was always making my own potting soil even in the early years. I had a neighbor. He had a company called Power Flower. They were making a local potting soil in Humboldt County. And I thought to myself as I saw his trucks go by my house every day, “Wow man. I think I can do this. I think I can turn it into a business.” I loved Dan’s product, but I made it better. I took his product and added more parts and pieces, which is a common theme in the cannabis industry. People want to mix in their own magic, so to speak.

So, I started importing coconut fiber way, way back before anybody even knew what it was, cocoa pith, cocoa quar, cocoa whatever you want to call it. It is the waste product from the coconut fiber industry. They’re these little short fibers that fall to the ground after fiber production. And they pack those, import them into the US, and then we process it into a peat-like substitute. The really interesting thing about cocoa is that it has a certain amount of natural potassium in it that cannabis loves. And it also has the perfect drainage and nutrient exchange rate that cannabis loves. In coconuts, just like cannabis, we have a long co-evolutionary history with them. They’ve really fed humanity and given medicine to humanity for eons, since our beginning really.

So all of my product has been coconut based in some form. And in Royal Gold, there was a completely cocoa based product, cocoa based soil. I’ve currently started a new company called Growers. We’re based out of Colorado. Our production will be up here in the summer of 2017. And we’re having a peat cocoa perlite-based products that allows our growers to be able to supply all of their own nutrients. Almost everybody has a magical, or their special recepie of nutrients. And our soil will allow you to be able to grow with any recipe that you have, or you want to develop.

The other part of your question is how did I come up with these formulas. You know, a lot of it was self experimentation, a lot of it was customer participation. Like over the years, I’ve been able to talk to hundreds, and hundreds of growers, and go and see hundreds and hundreds of grow rooms, hundreds of outdoors. It’s been a really an impressive education on soil, and soil management techniques across the board. And that’s really allowed me to see what the customer wants, and what’s really great for packaging, and just making money because that’s what we’re trying to do in business every day is make money, right?

So growers, it’s geared specifically towards the cannabis industry. It’s mostly inert product that has a specific drainage made for cannabis. We’ve now used some of the best soil scientist in the world to help us refine and develop the techniques, and the components that we’re putting in it. The highest quality cocoa fibers chosen, from 15 years in the industry, I literally chose it from the best guy. There’s one guy, and you know who you are. I’m not going to tell everybody, but thank you. There’s one guy who’s got the shit in cocoa fiber, and I get it from him. And then, there’s the highest grade peat. We source the highest grade peat in a local perlite product. So, it’s all highest end product, highest end inputs, highest end outputs, made specifically for cannabis growers and soil.

TG Branfalt: So I can tell just by talking to you, like, how passionate you are about dirt, right. And you’re an OG, you know. You were in Sweden, you were with some of the famous, you know, early growers. So, it’s interesting to get your take on, not just where you’ve come from … But how have you seen … I mean, obviously, when you started, there wasn’t the legalization that exists now, but how has the industry changed for you in the dirt game?

Chip Baker: Well, you know-

TG Branfalt: Because you can always sell dirt.

Chip Baker: Yeah, it has changed though, man, that’s for sure. You know, years ago when people grew indoors, they grew mostly hydroponic style. Right, because it’s really easy to hide that, and get the medium. That’s the material that you grow your plants in. That’s what we call it, medium. To get it in your house, rocks, or rock wool, it’s real lightweight. As cannabis changed … Let me back up. So, you had this lightweight growers, and then you had dirt growers. Back in the late 90s-2000s, that was the definition, dirt growers and hydro. Most of the dirt growers were in northern California because we had places we could hide. We had big open spaces. We had private spaces. And it was simple as like, Fox Farm Potting Soil and Power Flower Potting Soil. We’d fill these things up with buckets, put some plants in it, and start watering it.

Then, there was only a handful of nutrients on the market. You had pure blend and general hydroponics, and maybe a few others. Now, there’s dozens of different formulas. I mean, at our shop, Cultivate Colorado, we carry $2 million worth of fertilizer probably because everybody has their little specific thing that they want. So, the fertilizer game changes, and so the soil game has to change. Companies like Premier, and Royal Gold, and Botanicare, Sunshine, we all came to play with innert, pro-style potting mixes. Most of these mixes were developed out of UC Davis in the 50s, where lots of agriculture research came from. They said how much moisture rating, and how much air, and how much drainage you needed to have for a specific growing style.

All of us, Premier is the biggest people. Sunshine, they’re one of the biggest people. Fox Farm, I mean they’re the godfathers in the cannabis industry. And my little company at the time, we were all going towards this way of okay, we need some inert mediums, so that people can put their own fertilizers in it, and have access to all these fertilizers in it. So, now the industry, we all use hydroponic style mediums, but we’re basically growing in dirt, soil as the heady people say. And we take a container, we fill it full of an inert medium, and then we use a hydroponic style nutrient to feed the soil-less mediums. That’s the predominant way. Every single grow room I go into, 99% that’s what they’re doing. They have a soil-less medium that’s made of peat or perlite, or cocoa peat or perlite, or just cocoa. And they’re using their specially picked hydroponic style nutrients to grow in it.

TG Branfalt: So, the amount of knowledge that you’re just, like, dropping on me about dirt right now is absolutely mind blowing. Um-

Chip Baker: It seems like dirt. People ask me all the time, “Do you make dirt? How do you make dirt?” Right?

TG Branfalt: So I want to talk to you about how you’ve kind of shifted gears a little bit, and entered into a kind of consulting career. But before we do that, we gotta take a short break. This is the Ganjapreneur.com podcast, I’m TG Branfalt.

Commercial: This episode of the Ganjapreneur.com podcast is made possible by Name.com, a global provider of domain name, web hosting, and email services. Every successful cannabis business needs an online presence. And every successful online presence begins with a domain. From your website to your email address, a good domain is easy for your customers to remember. It looks nice on a business card or billboard. And it reflects the true identity of the project it represents. It’s important to reserve your domain early on when you are starting your business. As you may find, that the .com address of your preferred brand or concept has already been taken.

If somebody has already purchased the ideal .com for your business, they might be willing to sell it. But if they aren’t, you may have to get creative with one of the new alternate domain extensions such as .co, .club, .shop, or even .farm. Reserve your domain name today at name.com/ganjapreneur.

If you are a domain investor or venture capital firm interested in acquiring of advertising premium cannabis domains, go to the Ganjapreneur domain market to browse a wide variety of names including strains.com, cannabismedia.com, mj.com, and countless others. Discover branding opportunities for your next start-up, and learn about listing your premium domain names for sale at ganjapreneur.com/domains. Sponsored by name.com.

TG Branfalt: Welcome back to the Ganjapreneur.com Podcast. I’m here with Chip Baker. He is the host of The Real Dirt with Chip Baker, founder and former owner of Royal Gold potting soil, and founder and owner of Cultivate Colorado. So before the break, we were talking about your new grower soil, that project, and you also do a lot of consulting. So, why don’t you tell me, not how you got into consulting, but why you decided to get into consulting.

Chip Baker: Well, it’s actually kind of linked, man. One led to the next through running a potting soil company and a hydro store for, you know, 15 years, everybody comes through the door and has a story to tell, or has a question to ask. And over those years, I’ve gained a significant amount of knowledge from my other customers, the questions they ask, the problem solving that we went through to solve their problems. I’ve kind of just become, like … When the experts are stumped, they call me. Not to sound arrogant, but, like, I generally have an answer to every question based on some previous application. Randomly do I get stumped, but when I get stumped, I also have a pool of experts that I give a call, that know the answer.

So here in Denver, Colorado, real tight-knit community. Denver is where it’s all happening for the whole state pretty much. Growers come in, dispensaries come in, they start asking questions. I solve their problems quickly and easily. And just one thing led to another, and venture capitalists start calling. Financing people start calling. Big grows start calling. Governments start calling, just how it happens.

TG Branfalt: What’s one of the most common questions that you get from growers, people coming to your shop?

Chip Baker: It’s the same thing over and over again. Well, growers are constantly prideful in what they … Growers are prideful in what they do. People who grow cannabis are some of the most prideful people that I’ve met. A lot of the question is associated with the yield. That’s almost every person’s question is associated with yield. Like, “My yields are down because of pest. My yields are down because of watering. My yields are down because of environmental control.” At Cultivate Colorado, we have every size customer from grandma with one light, to the ganjapreneur with 1,500. And they all have similar questions about watering and environmental control, pests. It’s almost always the same.

TG Branfalt: And you said that you worked with government regulators. Can you describe that experience because, you know, I’m just wondering what is it like? Do they kind of turn their nose down at you? Is there any excitement at all from the bureaucrats who are involved in this?

Chip Baker: Yeah, now there is. I’ve always spoke openly about cannabis. Like, I can speak on pretty much any subject from water consumption to hemp, importation of CBD distilled. I’m just fascinated with all of it. And I understand it in a way that manypeople don’t. In the past, there was lots of sphere associated with that because I’m right upfront about it. Right? And now, people are fascinated. And they ask really interesting questions. And they’re questions of all types. You know, last week as matter of fact, Colorado were regulated how much cannabis a medical person can grow in their home. And previously, we had 99 plants. Lobbyist called up last week, and asked me like, “Hey Chip. How many plants do you have to have to sustain a six plant flower?” I was like, “Wow, that’s a really interesting question.”

The government, at the time, wanted to change it to just six plants, where you could only have six plants in your house. And my answer was 44 plants. That seems like a lot, but it’s not really. You need a mom, right, to get your cuttings off of. Then, you need to take, like, 25 cuttings because most people’s plants, half of them die off, right. Then, you’ve got 12 vegging plants at that point. And half of those might die off, or be bad, or you might want to throw them away. And then, you’re left with six, right. So, it’s not just this simple answer of plant six seeds, and get six plants. It’s a little more complicated. Unfortunately, they decided to go with the number of 16, instead of 44. But 16 is better than 6.

TG Branfalt: When we spoke about this last week, you had said that you’re actually more of a proponent of canopy size as oppose to plants.

Chip Baker: Yeah, restricting number of plants is useless. For instance, there’s a big movement going on right now in consuming raw cannabis leave. Well, one of the easiest ways to do that is through a micro greens type technique. And for that, you’d have 100 plants in 2 square foot area. So, the numbers of plants don’t really make sense to me. You can go one plant or 200 plants in the same area, and that’s what it all boils down to, its square footage. Now I’m of course in the business of retailing hydroponic and indoor growing equipment. I would like there not to be that strict of limits on this type of stuff, right?

TG Branfalt: Of course.

Chip Baker: But in California, and other states, they’ve had this canopy idea. This means that you have so many square feet that you can grow in. And that really is a better example of what’s going on. If you have a 10 by 10 canopy, right, that means the top two foot of all of your plants equal 100 square feet. Well, if you spread that outright, it might be 200 square feet of growth, but it’s 100 foot canopy. That kind of thing really makes sense. Man, how many times you counting how many tomato plants you planting in the backyard? You don’t, you don’t. And you go to the nursery to by petunias or mums, or something. And you just look at the six packs, and you’re like, “I want five of those.” You don’t think that there’s 30 plants there. You’re just like, “Oh, I think I’ll take that many.”

And that’s how we should be treating weed as well. The problem here is really based on this 1970s awful law that said that one plant equals one kilo of can-

TG Branfalt: What?

Chip Baker: That’s a federal law, when you look it up. And it’s all over the country. People still use this. They use this in Chicago. They use this in Georgia, is that one plant equals a kilo. And I have absolutely seen 10 pound plants, absolutely beautiful, huge, majestic, huge plants. Most plants don’t equal a kilo. Most plants equal an ounce. That’s 28 grams, right. So, that’s also part of it. They look at it and they’re like, “Oh six plants. Well, then you’re getting six kilos. That’s way too much, way too much.” Personally, that’s not too much for me. And I don’t think anybody should tell me it’s too much either. But it’s also not reality.

Most people grow six plants, and get six ounces. Most people that are actually growing inside their house, here in Denver anyway, you can go buy it for cheaper than you can grow it. It’s-

TG Branfalt: Yeah.

Chip Baker: … inexpensive here now. As little as $75 an ounce. Still as much as 300. So yeah, I just don’t think they have a grasp of really what’s going on. They still think it’s this evil plant. And like, “Oh, you can only have six.” It’s this gentle, beautiful, incredible piece of evolutionary history that we have together. And we should support it, and cultivate it as it cultivates us.

TG Branfalt: Well, I don’t think you, me, or anybody else listening to this podcast would dispute the symbiotic relationship cannabis has. And I want to talk more about normalization, and more about your role as a media host. But before we do that, gotta take a short break. I’m TG Branfalt with Chip Baker. This is the Ganjapreneur.com podcast.

Commercial: At Ganjapreneur, we have heard from dozens of cannabis business owners who have encountered the issue of cannabias, which is when a mainstream business, whether a landlord, bank, or some other provider of vital business services refuses to do business with them, simply because of their association with cannabis. We have even heard stories of businesses being unable to provide health and life insurance for their employees because the insurance providers were too afraid to work with them. We believe that this fear is totally unreasonable, and that cannabis business owners deserve access to the same services and resources that other businesses are afforded. They should be able to hire consultation to help them follow the letter of the law in their business endeavors, and that they should be able to provide employee benefits without needing to compromise on the quality of coverage they can offer.

This is why we created the Ganjapreneur.com business service directory, a resource for cannabis professionals to find and connect with service providers who are cannabis friendly, and who are actively seeking cannabis industry clients. If you are considering hiring a business consultant, lawyer, accountant, web designer, or any other ancillary for your business, go to ganjapreneur.com/businesses to browse hundreds of agencies, firms, and organizations who support cannabis legalization, and who want to help you grow your business. With so many options to choose from in each service category, you will be able to browse company profiles and do research on multiple companies in advance, so you can find the provider who is the best fit for your particular need.

Our business service directory is intended to be a useful, and well maintained resource, which is why we individually vet each listing that is submitted. If you are a business service provider who wants to work with cannabis clients, you may be a good fit for our service directory. Go to ganjapreneur.com/businesses to create your profile, and start connecting with cannabis entrepreneurs today.

TG Branfalt: Welcome back to the Ganjapreneur.com podcast. I’m your host, TG Branfalt here with Chip Baker, host of The Real Dirt with Chip Baker, founder and former owner of Royal Gold Potting Soil, founder and owner of Cultivate Colorado. So, you’ve spent your whole career in dirt, and helping people as a consultant, and then you end up doing a podcast. How do you end up there, man?

Chip Baker: God, you know, I wanted to tell people stories man. I have these incredible friends, and they get interviewed by NBC and CNN and Fox News. The journalists don’t ask the right questions. They don’t know what questions to ask. And I saw this every time I’m reading an article on cannabis. I shouldn’t say every time, but many, many, many, many times it’s just the same old, “Oh, you guys must get really stoned at work today.” And that might be part of it, don’t get us wrong. But there was a deeper level of conversation that I believe it needed to have. And man, I just got some friends with incredible stories.

Like, Christian Sederberg from the Vicente Sederberg, he’s an attorney who helped legalize cannabis here in Colorado, has a law practice that is primarily cannabis related for people all over the world, man. Jordan Segota, just an incredible extractor. Justin Jones, and my buddy Matt Bickle are both successful cannabis growers, and now consultants for people all over the world. I just kinda wanted to share their stories, man. I thought it was fun. I also just sold all my interest in Royal Gold, and was feeling really creative. I had this huge amount of success from this business that I had created and built from the ground up, from literally, like $1,200. I started in 2002 with it. And I couldn’t say how much business they do now, but they ship all over the world.

That makes me feel really good for sure. And just wanted to, like, tell these stories. They we just interesting to me. Podcast, I haven’t had that many downloads. I’m a boutique podcast as of now. Right, I think I’ve had about 10,000 downloads that I can track. And I get people that come up to me now and say, “Hey, you’re Chip Baker from The Real Dirt.” And we usually smoke out and talk about their favorite episode, or they tell me something that they’re interested in. Yeah man. That’s kind of why I do it, is I’ve always loved radio. I’ve always loved the stories. I’ve always love this American life, and NPR type stories. And it’s what I want to be a part of it.

TG Branfalt: So, when you said that most reporters don’t ask the right questions especially … And I gotta agree with you as somebody who has a Master’s degree in Communications, who studied journalism, who-

Chip Baker: Yeah, you know ganja to some degree. And you’ve been around it. I haven’t read any of your work Tim, I’ll be honest with you, but I’m sure you probably can ask relevant questions other than, “Are you getting stoned at work?”

TG Branfalt: Well, I mean focusing on the business aspect of it. The normalization is a huge thing. I think anybody who, like, gives a damn about the advocacy end of it … It’s all normalization when it comes right down to it. We want our businesses. In my case, I want the stigma to be over, so when people see me with my long hair, and my kind of laid back, and they think stoner, they don’t think, “Well, he’s not going to be a good worker. He’s not good for the brand” if that makes any sense. So-

Chip Baker: Yeah, I try to break that right there because I’m a stoner, 100% man. I’ll tell you that. I love it, and there’s nothing wrong with it. So, I’ll bring it up immediately with people all the time. And it makes them feel comfortable, and I smoke with people who never smoke. I smoke with people who have never smoked. People come to me and say, “Hey man. I’m really interested in trying it.” I kind of make it normal, right?

TG Branfalt: I mean you grew up in Georgia, right? So, probably growing up for you, there was a far more stigma for … You know, I grew up mostly in the northeast, New York and Connecticut, where it’s a lot more liberal than Georgia, where people still go to jail for a long time.

Chip Baker: Oh yeah, man. I’ve got a family friend who’s looking at a felony for a joint right now in Georgia.

TG Branfalt: A joint?

Chip Baker: A joint. A joint because they turn that into resisting arrest, and they whipped his ass, put him in jail. It became this thing because that’s how it works. There’s never just one thing, right?

TG Branfalt: So, in your podcast, what were some of your favorite guests and your favorite interviews that you’ve done in that role? Is it with people that you’ve known for a long time that you’re just being able to ask them questions that you may not have gotten to before, or is it with people that you really never met.

Chip Baker: A little bit of both. Mostly, they’re friends of mine. I have pretty good Rolodex of people that have asked me questions in the past, maybe owe me a favor, or you know, have grown in their businesses to where they’re just a powerhouse, right. So that’s part of it, but yeah, you said it right there. I get them in the studio here. I’m in the Real Dirt studio right now. I get them in here, and they put the headphones on, and they got a microphone in front of them, and they’re just transported. And I keep saying psychedelic experience. I guess I’m on that frame of mind today, but we do have this bonding psychedelic experience because headphones are on, and it makes that controlled sound. Your voice is modulated a little bit. It puts in a little bit of an altered state. We are smoking weed for sure. People, like, tell me things they haven’t told me before.

I have really good, open conversation. Some of the best conversations I’ve had with my friends doing the podcast. People feel like they can really talk about what they’re doing, and that it’s a professional conversation. It encourages them. It encourages me too, you know. Most of my podcast interviews, we leave here, and we high five each other, and we’re like, “Ah, that was great man. Ah, I never knew that about you. Thanks for all that information.” Like with Andrew Livingston, he’s a statistician for Vicente Sederberg’s and a researcher. He came here, and I got to ask him all the stats, all the information, on how much people are making, how much weed was selling, the direction. We got to chat these mathematical theories. That’s hard to come by. But he studies the data that comes out of the tracking system for this year, the state of Colorado.

So, he was definitely one of my favorites. It’s kind of a little nerdy of a podcast, so you gotta be into numbers and shit, business in order to really like that one. My longest and favorite podcast, though, is with my friend, Matt Bickle. We’ve been friends for 10 years, and in 2009, he really became involved in the medical cannabis industry. I’ve been able to watch him grow from having a four light grow to working for a 10 light dispensary, a 40 light dispensary, and now he’s a consultant all over the country, motivating and helping people to set up cannabis facilities, and grow quality cannabis.

I’ve got one later on today that I’m really excited about with a friend of mine who’s got an ancillary business. I won’t speak of her name yet. I don’t know if I can say I have a favorite one. I often ask people what their favorite one is. And I get a Jordan Segota, which that’s probably my most interactive. He’s a really colorful character. We smoked like, dude I swear, an ounce in blunts while he was here. He’s really descriptive. He’s an extractor looking for the highest quality product, and it’s branding his product in a unique and different way. And lots of people really loved that one.

My most downloaded ones are the Christian Sederberg and Matt Bickle episodes. You can listen to these episodes if you want to be in the cannabis industry. This is what the byproduct of it was. So, if you want to be in the cannabis industry, you listen to four or five of these episodes, and you get to talk to guys that you might not be able to afford to talk to. Or might not be able to get on the phone because there’s a line of 10 deep billionaires that want to talk to them. If you listen to episodes from Jordan Wellington and Christian Sederberg, Justin Jones, Matt Bickle. You listen to those, and you’re interested in starting cannabis facility, a legal cannabis production facility, you can start and talk about it to people with a high degree of intelligence.

That’s hard for people to get, you know, especially for free. You gotta find an attorney, pay them. Find an accountant, pay them. Find a consultant, pay them. And then you might not know what questions to ask. So, it’s really become a valuable resource for people, which is kind of just an interesting byproduct. I never thought that would really happen.

TG Branfalt: Well, with doing these interviews in the same way as all podcasters, such as myself, we do these interviews, and we’re trying to create something informative. We’re acting as independent media. You know, I went to school studying media. So, for me, it might not be that shocking that I end up in the media —

Chip Baker: It’s the modern world though, man. It’s the beauty of it. Like, I started my podcast with maybe $500 worth of equipment: a Mac, an HD Zoom 6, and a microphone. And I collected gear along the way, but that sounds so good. It’s just incredible. And with the editing, I’m using a virtual editor outside the country. They edit all of my stuff. It’s not that expensive. Everybody has the access to it. Anybody can open up a Facebook account, and say, “Hey, I’ve got a podcast. Listen to it.”

TG Branfalt: So, what do you think of the role that you’re playing as the independent media? What is the importance of having independent media in a space that we both agree isn’t well covered by the mainstream?

Chip Baker: Well, nobody’s funding me to do it. I get to talk whatever I want. And even if I do have some sponsors, I don’t do any product placements specifically for them. If their product comes up, it comes up because I like it. Like, dude, I love these Pax pens. They’re not a sponsor, but they could be. I’d love to have some sponsorship on those. But I can’t be bought necessarily. I’m not looking for advertising dollars. So, it’s this underground thing that gets to happen. And we get to talk about the undergroundness of it, where you know how much media is controlled these days. And for instance, in my industry, the LED technology really doesn’t work that well, but there’s this whole media push by some group of people that I don’t know, that drives people in my store all the time asking for LEDs. And all of the general public, they want to know about LEDs.

I think that’s manipulative. And you know as a reporter, how much stuff gets manipulated, either edited out, or purposely made to support some economic gain. It’s business, man. That’s just how it is. There’s no real business for me on this. I just want to do it.

TG Branfalt: So where can people hear your podcast? Where can they get information about the new grower soil? And is there anything else that you’re working on?

Chip Baker: Oh yeah. You know, I’ve got a dozen things going on all at once. But I’m learning to play the banjo right now.

TG Branfalt: How’s it going?

Chip Baker: It’s going pretty good, actually. My southern roots have drawn me to that lonesome sound of the banjo.

TG Branfalt: You can play the thing from Deliverance, right?

Chip Baker: You know, because I’m from the south, I’m not going to learn to play that.

TG Branfalt: That’s the only reason people get a banjo, dude.

Chip Baker: Oh shit, no. Yeah, just that reverberation, that bwang sound is the same sound I hear in my head when I get stoned. So, yeah let’s say it. Cultivatecolorado.com, TheRealDirt.com, you can see it on iTunes, Stitcher, and SoundCloud. You can follow me on The Real Dirt, on my Facebook page. You can look me up on Instagram just at Chip Baker. I’m always posting some cool pictures of grows that we get to go see. And GrowersSoil.com, that’ll be coming out here in the summer time.

TG Branfalt: Dope man-

Chip Baker: So, want to reach out, you ever got a question, something interesting to say, give me a call man.

TG Branfalt: Dude, it’s been a pleasure. It’s been one of the more fun episodes that I’ve done lately. You can find more episode of the Ganjapreneur.com podcast in the podcast section of ganjapreneur.com in the Apple iTunes store on the Ganjapreneur.com website. You will find the latest cannabis news and cannabis jobs updated daily along with transcripts of this podcast. You can also download the Ganjapreneur.com app in iTunes and Google Play. This episode was engineered by Jeremy Sebastiano. I’m your host, TG Branfalt.

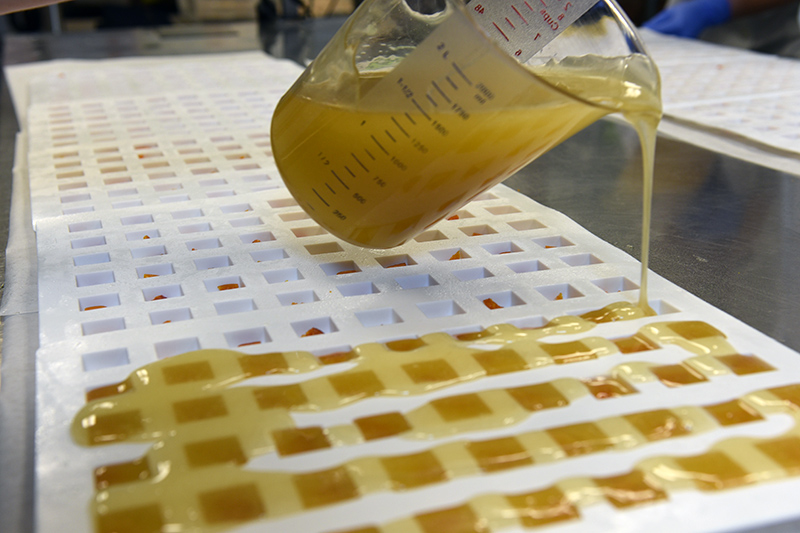

Ohlson has helped businesses increase efficiency in their packaging procedures since the company’s founding in 1967. Since then, the company has worked alongside the largest of Fortune 500 brands and small-time family shops alike but only recently turned its attention to the cannabis industry.

Ohlson has helped businesses increase efficiency in their packaging procedures since the company’s founding in 1967. Since then, the company has worked alongside the largest of Fortune 500 brands and small-time family shops alike but only recently turned its attention to the cannabis industry.