H.R. 1595, better known as the SAFE Banking Act, received a full House floor vote this afternoon, passing the chamber in a bipartisan 321-103 vote. It was the first time that stand-alone cannabis legislation was considered by the full U.S. House of Representatives.

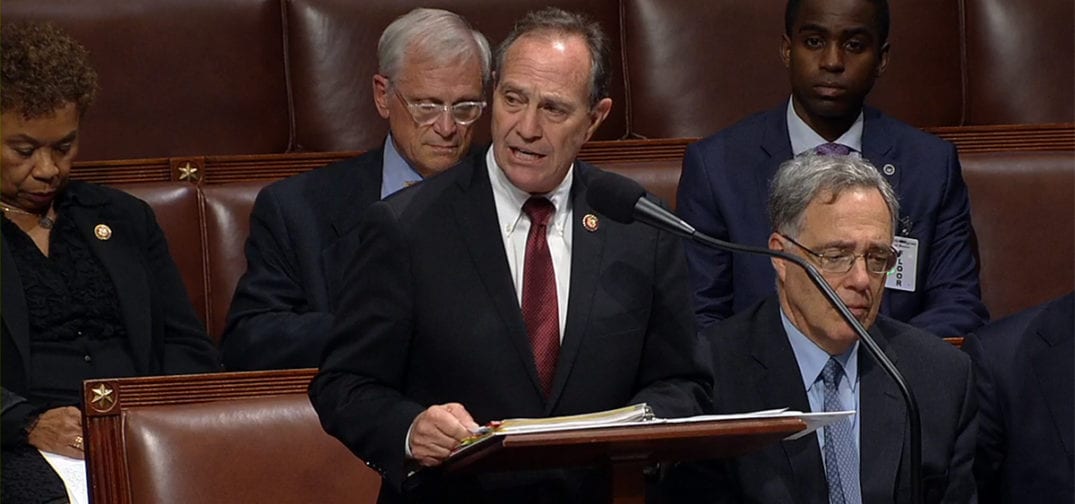

The bill aims to remove the cash-only element from state-legal cannabis industries by explicitly giving banking rights to cannabis businesses and related companies. The bill’s primary sponsor Colorado Rep. Ed Perlmutter (D) said during his opening remarks that the Act’s main purpose is to support “public safety, accountability, and states rights.”

Some activists have criticized the effort for not going far enough to reform federal cannabis laws, but many cannabis advocates have applauded the SAFE Banking Act as a logical first step toward repealing the federal prohibition of cannabis.

“For the first time ever, a supermajority of the House voted affirmatively to recognize that the legalization and regulation of marijuana is a superior public policy to prohibition and criminalization.” — NORML Political Director Justin Strekal, in a statement

Lawmakers from both major political parties rose in support of the bill.

“The Financial Services Committee heard testimony in February that these cash-only businesses and their employees have become targets for violent criminals,” said Rep. Maxine Waters (D-CA), who chairs the Financial Services Committee, during the floor’s 40-minute debate. “The SAFE Banking Act addresses this serious problem by providing safe harbor to financial institutions that choose to serve state-regulated cannabis businesses.”

H.R. 1595 — which enjoyed more than 200 cosponsors in the House — now moves to the Senate for consideration.

The bill is supported by numerous law enforcement and banking organizations, including the National Association of Attorneys General, the American Bankers Association, and the Credit Union National Association.

Get daily cannabis business news updates. Subscribe

End