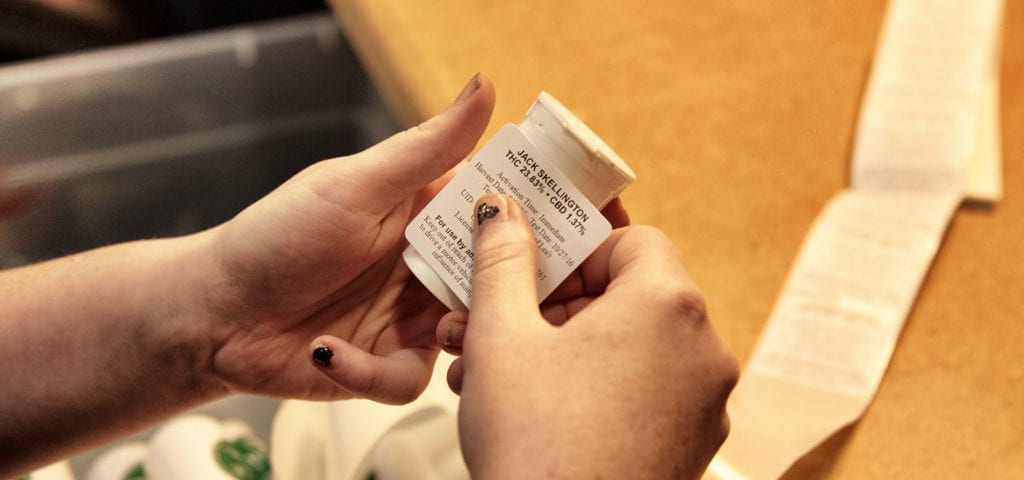

An employee at a Rhode Island medical cannabis dispensary has been denied a mortgage by Home Loan Investment after the company deemed his “marijuana-related business” income unacceptable, according to a GoLocal, Providence report. John Guardarrama, a cultivator for Summit Compassion Center, was previously given preliminary approval for the loan last July but was denied final approval in January.

Christine Hunsinger, assistant deputy director for policy and research for Rhode Island Housing, said that cannabis’ federal status as a Schedule I drug could create a conflict between some home loans and federal loan guidelines.

“Regarding compassion center workers, most of our loans are FHA (Federal Housing Administration) loans, which must comply with their underwriting guidelines. FHA will not purchase or invest in a loan where the borrower is employed by or receives compensation related to the marijuana industry.” – Hunsinger in a statement to GoLocal

The Guardarramas believe that the denial is due to the revocation of the Cole Memo protections by Attorney General Jeff Sessions in January, which came just days before their loan application was denied. Melissa Guardarrama said that one of her husband’s colleagues at Summit was previously approved for a mortgage by the loan company – although she wasn’t sure if that occurred before or after the federal change. The family – who had spent funds on inspections and applications – was expected to close on the home Jan. 19.