Tad Hussey of Keep It Simple Organics was recently a guest on the Ganjapreneur.com podcast, and he and our host Shango Los had a discussion about wild-crafted probiotic nutrients. The response we got from our listeners was so enthusiastic that we invited him back for another two episodes! In our second interview with Tad, he gives us an overview of what his process is for creating custom soils, what some of his favorite ingredients to use are, how to get your soil tested to know exactly what nutrients it has and what it needs, and even what his own preferred recipe is for creating a a soil from scratch.

Listen to the episode below, or scroll down for the full transcript!

Subscribe to the Ganjapreneur podcast on iTunes, Stitcher, SoundCloud or Google Play.

Listen to the podcast

*Note: You may have noticed that our podcast format has recently changed. We have been experimenting with our format recently, and have decided to take our show in a new direction. Based on the feedback we have received, we are changing up the structure and stripping away much of the added production and sound effects in order to deliver something a bit more down-to-earth and easy on the ears. This also means that we are now booking our own commercials. If you are interested in connecting with our audience in the most personal way that we can offer, send us an email at grow@ganjapreneur.com and we can talk about you becoming a commercial sponsor of the podcast. It is our hope that these changes will make the podcast an even more pleasant listening experience moving forward. Thank you for being a part of the Ganjapreneur family!

Read the full transcript

Shango Los: Hi there, welcome to the Ganjapreneur podcast. I am your host Shango Los. The Ganjapreneur.com podcast gives us an opportunity to speak directly to entrepreneur’s, cannabis growers, product developers and cannabis medicine researchers all focused on making the most of cannabis normalization. As your host, I do my best to bring you original cannabis industry ideas that will ignite your own entrepreneurial spark and give you actionable information to improve your business strategy and improve your health and the health of cannabis patients everywhere.

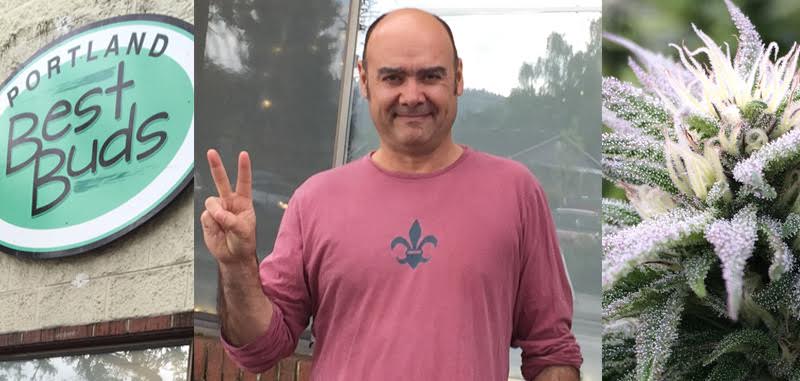

Today is part 2 of our 3 part series with Tad Hussey of Keep It Simple Organics founded my Tad’s father, Leon Hussey, Keep It Simple is an edible nursery production green house, outdoor preschool, organic hydro-shop and feed store in Washington state. Tad is an educator and sought after speaker on probiotic growing. During the first part of the series, we talked about wild crafting probiotic nutrients for nutrient teas. This week we are going to talk about building your soil from wild crafted and alternatively sourced inputs to save you money on store bought inputs. Our third visit with Tad in a couple weeks, we’ll be talking about compost tea. Welcome back to the show Tad.

Tad Hussey: Thanks for having me back, I’m excited to be here.

Shango Los: The response from your first visit was so strong, I knew I had to have you back to talk more about ways to wild craft to save money on store bought nutrients. Before we get into the specifics of what inputs to use for building soil, let’s set up a framework of what building soil means. Many new growers just grab a bag of potting soil and go for it. Why is knowing how to build a soil from scratch important?

Tad Hussey: That’s a great question, Shango. One thing I noticed is the traditional method for growing is you start with a base media that’s relatively inert, then you go out and buy these expensive bottled nutrients to water into the soil and grow your plant then you throw out the soil at the end of your growing cycle. With building your soil and knowing what’s in your potting soil, you can add the minerals and nutrients that your plant needs right into the Rhizosphere so the plants really in control of it’s growing habits. You’re not spending money on these expensive bottled nutrients, when you start looking at what’s on the label in a lot of these organic nutrients, these are things you can put directly into your soil prior to ever planting your plant.

Shango Los: I would think that if you build your soil right, the nutrients are always there so it becomes a buffet situation for your plant that instead of there being a lot of nutrients then less nutrients, then a lot of nutrients when you water again that if you’re putting it in the soil, the nutrients are just kind of always there. It’s like on demand nutrients for your plant. Am I picturing that right?

Tad Hussey: Yes, exactly. It takes time for these nutrients to become plant available because when you add organic bottled nutrients or you add amendments into your soil, they’re not immediately available to the plant. You’re not feeding the plant, you’re actually feeding all these microbes in the soil that then help make these nutrients plant available. By getting them into the soil early, letting the soil nutrients cycle and prep and then planting your plant, you’re just going to have a healthier happier plant. It’s going to be more disease resistant and you’re going to get a better overall yield.

Shango Los: Right on, that makes a lot of sense. The last time we talked to you we talked a lot about nutrient teas and how to wild craft, meaning grabbing plants from your yard or other places in the natural environment that we could make into teas to feed the soil. Now we’re talking about similarly, how to wild craft more alternative sources for building that soils environment for all the microbes. Why don’t you just start from the beginning and tell us how you recommend that people build their soil?

Tad Hussey: Sure. Now in addition to your yard, I’m going to send you to your local feed store. That’s the next best place to look for a lot of these amendments. In addition to a feed store, your local garden center, nurseries, these are all great places to look for things. A variety of amendments that we would want to use would be things like organic alfalfa meal or fish meal or fish bone meal. There’s a bunch of minerals like glacier rock dust, there’s so many things that we can incorporate into our soil that it’s pretty damn amazing what our options are.

Shango Los: Let’s start at the top. Let’s say you’re working with a client and let’s say they’re a commercial client, they are asking you how they are going to save money from buying all these bottled nutrients. Where would you start with them? What would you tell them the first things to go collect? I know there may be more nutrients than we’ve got time for today, but kind of give us a rough guide walkthrough for folks. They can add or remove amendments as they want.

Tad Hussey: Sure. If you were for example, growing outdoors, the first thing I would have you do is get your soil tested to see if that’s something we can use and amend appropriately. By getting a soil test with Logan Labs, they’re probably my favorite soil testing lab, it costs $25 for a standard soil test and that will give us all the trace minerals that your plant needs as well. This is my initial starting point, if we’re talking about building soil from scratch, say a potting soil or indoor soil environment in that case what I like to do personally is do a mix of about 50% peat, 33% aeration in the form of per-lite or pumice, and 17% to 20% is earthworm castings or compost. You can also use cocoa if you prefer instead of peat, personally I prefer peat for a variety of reasons. If you do use cocoa, you’d want to incorporate a little bit more sulfur and calcium in the form of gypsum.

Shango Los: When you were talking about potentially using the soil from your own yard versus bagged soil for growing outdoors, is there a good reason why you wouldn’t use soil from your yard indoors?

Tad Hussey: No, it’s just that with an outdoor environment, it makes sense to me to just utilize the existing soil. For an indoor growing environment, a lot of times we want to really tailor the media for optimization. That being said, if you have wonderful soil in your garden then there’s absolutely no reason you couldn’t bring it inside to grow your plants, just keep in mind you are potentially bringing in diseases or pests or pathogens. In my experience, I’ve found outdoors there’s enough things in nature that will just take care of a lot of these problems and sometimes when you bring that soil inside you can potentially be exposing yourself to some of those issues.

Shango Los: I understand. It’s like you’re potentially bringing in contaminants because you’re bringing in wild soil essentially.

Tad Hussey: Sure, I don’t want to say that it’s not possible or even discourage people from doing it because I think that’s a great and really affordable starting point for people in building soils but just aware in the back of your mind that that is a potential.

Shango Los: We’ve got listeners in all parts of the country, and they all have got different soils but are there certain things that are common when people get back their soil test? For example, Logan Labs or somewhere else, or is there as much variety in tests as there are in regions in the country?

Tad Hussey: Yes, soil can very so much just based on your region. If your soil is very high in calcium, you’ll actually have to do a slightly different test with Logan Labs but that’s something you would probably want to contact them directly on. Here in Washington state, we can just go with the standard soil test to get those results.

Shango Los: After you get the soil test, do you do a little consultation with Logan to have them help you read it? Then you’re going to figure out what you would want to amend into your soil to bring it to where you want it to grow, am I following you?

Tad Hussey: Sure. In my experience, they’ll make recommendations a lot of times or you can pay for that recommendation. I’d say about 75% to 80% of those recommendations are pretty good. I like to make slightly different amendments for cannabis than I would for a traditional farm crop which is what they’re recommending towards, or a garden. It would at least tell you if you have any major excesses or deficiency’s.

Shango Los: Right on. I know a lot people are really excited to hear your specific recipe and I know you’ve got it from a really profound source. We do need to take a short break first, when we get back we will go through your recipe. You are listening to the Ganjapreneur podcast.

The Ganjapreneur.com podcast is going to sound a bit different going forward. If you heard the show last month on CDB derived from hemp, then you probably noticed we’ve been experimenting with the format. We got really good feedback on that episode so we’ve adopted those changes permanently starting with this episode. That means the show is going to be a bit less produced in Wizbang and a bit more down to earth and pleasant on the ears. We also didn’t use to control the commercial content and we, and many of you, thought it sounded a bit out of sync with the rest of the vibe of the show.

Going forward during the commercial breaks, we’re going to bring you companies that we believe in. We’re going to tell you about them, tell you how to get in contact with them and then we’ll get back to the show. Pretty simple really. We got to thinking about why we do this and that how on the internet, we can be whatever we want to be. We decided to strip of all the monster truck rally production and are just planning on hanging out with you.

This change also means that we are booking our own commercials now. If you want to reach out and connect with our audience in the most personal way that we can offer, drop us an email grow@ganjapreneur.com and we can talk about you becoming a commercial sponsor of the podcast. It’s our hope and intention that these changes will make the podcast an even more pleasant listening experience. Thanks for listening and being part of the Ganjapreneur family. Now back to the show.

Welcome back, you are listening to the Ganjapreneur.com podcast. I am your host Shango Los and our guest this week is Tad Hussey of Keep It Simple Organics. Before the break we were talking about how important it is to get your soil tested so that you know what you’re beginning with if you’re going to amend your soil. Tad was going back and forth about the differences between using your outdoor soil for outdoor and maybe starting with more of a sterile soil for the indoors. Tad, now we want to hear your specific recipe because I’ve heard from a lot of people that this is a really solid recipe and it’s the one that you give to your clients. Let me just hand you the mic and let you go through your recipe.

Tad Hussey: Thanks Shango. Probably my favorite online free recipe for building soil right now comes from a gentleman that goes online by the name Clackamas Coot. He’s a good friend of ours and was instrumental in helping me when I first was building our soil recipe prior to doing any of the lab testing and subsequent work that we’ve done over the last 10 years.

The recipe that Clackamas Coot gives out is approximately 1/3 peat moss, 1/3 high quality compost or earthworm castings and 1/3 aeration in the form of pumice or per-lite with 10% of that being able to be made up from rhizaels as well. To that, he adds a half a cup per cubic foot of neem cake or karanja cake, kelp meal, and crab and crustacean meal. In addition to that, you’re adding 4 cups per cubic foot of the following mineral mix, which is one cup glacial rock dust, one cup gypsum, one cup oyster shell or egg lime and one cup of basalt.

Don’t get caught up that you have these exact ingredients, it’s really best to source what you can locally not just from an environmental perspective but also as a cost savings with the freight of moving these minerals around the country. If you aren’t able to source a particular mineral locally, there’s a very good chance we could substitute it for something in this recipe.

Shango Los: Where do people pick up these inputs? I’m sure that some of the long time growers go, “Ah, I know exactly where to get that,” but a lot of our folks may not. Is this all going to be at the feed store?

Tad Hussey: Some of it’s going to be at the feed store, some of it may be at your local garden center and some things you may unfortunately have to find online. Neem cake and karanja cake is one that’s a little bit tougher to find locally depending on where you live in the country. The kelp meal should be something that your local feed store would carry, and crab and crustacean meal is another thing you might be able to find at a local garden center. You’ll definitely be able to find gypsum locally and some sort of rock dusk and the agricultural lime. Many of these things are source-able locally.

Shango Los: I guess one of the things to point out too, is if the goal is to use the product that’s as close to nature as possible and if the goal is also the save some money that the closer you are to buying it in bulk by the scoop, the better for you. Because every time somebody packages this stuff up to sell it to you they are adding more to the cost.

Tad Hussey: Exactly. It’s much better to find these raw amendments. Even if you say for example pay a little bit more to buy these ingredients online, you’ll probably still be saving money on what you would pay for a bottled nutrient at the local hydro shop.

Just to get you back to this recipe, one thing I wanted to add is a lot of the recommendations by Clackamas Coot are in half a cup per cubic foot. This is a pretty safe recommendation for people in terms of wanting to add different amendments of other types to their mix. Assuming you wanted to add a little bit of organic fish meal or fish bone meal or alfalfa, these things at a half of cup per cubic foot are probably okay. Just keep in mind of your NPK values as you add these things to make sure you’re not getting and over abundance of any particular macro or micro nutrient.

Shango Los: I was just thinking about that. We’ve probably got a lot of listeners that are going to be very specific about measuring this stuff out. Then you’ve got other people like me who are a little more iron chef-ing it in the kitchen. These are general numbers, I’m getting the idea that as long as you don’t stray too far, this is kind of a hard thing to screw up.

Tad Hussey: Exactly, we’ve definitely tested and pushed the upper limit of this with our soil mix. I’m putting in almost 100 pounds of nutrients per yard of soil into our soil mix. We have to let it heat and cool as it nutrient cycles for at least 2 weeks prior to planting in it. Then we’re able to make it through an entire growing cycle without having to add any other inputs besides water.

Shango Los: Let’s say that we’ve gotten all these important inputs and they look beautiful all set up together. How does one go about actually mixing them? I’d actually ask for 2 answers, one for the home grower who is doing a couple yards of it then something scalable solution for somebody who is doing this at a commercial option. I know that friends and growers, they just throw it all in a tarp and then scoop it around and mix it up by hand. Do you have a more elegant way to do that?

Tad Hussey: Well, this is probably the toughest part of building your own soil to be honest. It is some labor and I highly recommend wearing a dust mask or respirator when you do mix these ingredients. A tarp is probably one of the simplest and easiest ways to do this. I’ve personally don’t like using a concrete mixer because I find it is really messy. In general, the other option is if you have a small tractor, you can scoop the ingredients and move it around that way on asphalt or concrete. Mixing soil is tough work which is why we typically recommend reusing the soil. Once you use the soil once, you’re not doing this over and over again.

Shango Los: Reusing the soil is a good point. I know a lot of growers, they use all brand new soil every time that they do a grow and from hearing you speak, I’ve heard you talk about reusing the soil. Why don’t you talk a little bit about the benefits to amending your own soil and it’s re-usability and what amendments you may need to add a second time.

Tad Hussey: There are so many benefits to reusing your soil. One, if you are in a garage or a large scale facility, your biggest time and cost and expense is moving soil in and out of the facility and deposing of that soil. Not only that but if you’re using chemical nutrients and you’re disposing of this soil, you’re potentially leaking nitrates and phosphates into our ground water and contaminating our environment and ground water systems. There’s a ton of benefits there. In addition to that, our goal as we make this soil is to work towards having living soil. We’re building and mimicking nature here as we go over time.

Many of these minerals that we’re adding in this recipe are not even plant available that first cycle. The idea is that these nutrients will be released over time. What we’ve done with our soil mix is we’ve actually tested it up to 4 years out at 4 cycles a year. The production actually improves after that first cycle as the microbes establish more and more soil structure. The goal is building toward this soil structure in your garden indoors.

Shango Los: That’s the antithesis of what I hear more often for folks. They want to make sure they’re giving their plants the most to thrive on so they’ll either buy pre-done soil or they’ll build a soil new each time. What you’re saying is some of the stuff isn’t even available the first time around so it might actually be better your third cycle or your fourth cycle. How long do you need to let the soil rest between growing cycles?

Tad Hussey: That’s going to be entirely dependent on how many nutrients you’re adding per growing cycle. For example with our soil what we do in an indoor raised bed is our idea of an optimum environment because we’re giving each plant more access to soil and media. What we would do is literally harvest the plant at the end of the cycle and shake off the soil that comes out with the roots and take that plant away and harvest it. Then what we do is mix in what we call a nutrient pack but it’s just a combination of organic minerals and nutrients similar to what we talked about in the Clackamas Coot recipe. You would mix that back into the soil, add a little bit of compost and maybe a little bit of aeration if this soil needs more drainage.

If you think about it, every time you harvest a plant you’re pulling out organic matter and you’re pulling out nutrients because this isn’t a closed loop, these are things that need to be replaced every cycle. The cost to replace that and the amount that you’re adding is so minimal compared to what you’re putting in initially that you end up saving a ton of money. You’re really only disturbing the top 2 or 3 inches of the soil which are designed to be deserved by nature in a natural system. Overall, you end up with a happier, healthier plant. In your time down if you’re amending at these lower rates is really only 24 to 36 hours before you’re bringing back in your next crop of vegetative plants into that flower room.

Shango Los: How do you know? I know you said that you use the Keep It Simple nutrient pack but for folks who are going to do this themselves, how do they know what percentage of the original recipe they should add during the resting part of the cycle? Is it easy to say across the board, “Just add 10% of each of the inputs and that should be good,” or how should folks think about that?

Tad Hussey: If it were me, I would probably start adding back in half a cup per cubic foot of all those main ingredients and maybe 2 cups per cubic foot of the mineral mix as an initial starting point. It really depends on how large of a pot you’re growing in and how large your plant grows to determine how much nutrients are being taken out of the soil. Here’s where another soil test would give you a base line for what you need to re-amend. You really just have to pay attention to how your crop finished and how that amendment you made at the beginning of the next cycle effected that crop. Over time, you kind of get a feel for the soil and learn how to work it to where you can manage your inputs appropriately.

Shango Los: Right on. We’re going to take another short break and be right back. You are listening to the Ganjapreneur.com podcast.

Entrepreneur’s across the country are establishing businesses in response to cannabis normalization. Once a state becomes legal for cannabis, they all go through similar growing pains. New business owners must develop a business plan, a brand, learn growing and processing techniques and develop products from those new skills and get them to market. Most challenging, they must learn how to work creatively within the narrow bands of legality set by their state regulators. Each step in this process is filled with hidden delays that burn resources.

The most common challenging belief that I have seen from my own clients and other players in Washington, Colorado, and Oregon is that they think they can do it all themselves. Or worse, that they have to do it all by themselves. This is simply untrue and in most cases will cost you a great deal of time, money, and frustration. We have reached the point now that there are exceptionally good cannabis consultants who have learned from their mistakes, risen to the top of their own markets and now offer this advice to new cannabis entrepreneurs in states that are just moving into production now.

One of these is Green Lion. Green Lion was an early player in the Washington medical market, they grew up during times of confusing gray market regulations balancing between honoring the Cole 2 memo in state cannabis laws while continually striving to push the market forward with ground breaking growing, processing, and products. Green Lion was in the first round of licences awarded by Washington State, and they began the difficult challenge of running tandem medical and state licensed recreational operations while being a shining example of creating revenue and staying within the fine details of state law. Their extraction lab uses a variety of methods and has a reputation for producing exceptional oils and an employee training program taught by folks who are now industry leaders. Green Lion can help you attain your own cannabis sales goals. They’re multifaceted team has the expertise you need whether it be growing, extraction, product development, branding or support working through your state licensing process.

Green Lion is also now acquiring established medical and recreational marijuana product lines to bring into the Green Lion family. If you have an established product and want to participate in the licensed cannabis market, Green Lion could be the place for you. They will fold your manufacturing team into their production and get your proven products into the hands of cannabis enthusiasts everywhere. Finally, do you enjoy fine cannabis oil? Green Lion presently provides recreational and medical products made with their premium oils throughout Washington state. Ask for Green Lion dab oil, Co2 oil and kief infused pre-rolls, vape cartridges and full plant extract topical’s at your favorite retail location.

Get your pen ready because here comes the contact information. If you want to achieve a positive cash flow in a shorter time, reach out to Green Lion. If you have a marijuana business that needs to find a licensed home to manufacture, reach out to Green Lion. Drop a line to contact@greenlionindustries.com and let them know how you want to work together. Tell them Ganjapreneur sent you too. That email address is contact@greenlionindustries.com. Now, back to the Ganjapreneur.com podcast.

Welcome back, you are listening to the Ganjapreneur.com podcast. I am your host Shango Los and our guest this week is Tad Hussey of Keep It Simple Organics. Tad, right before the break you said something that totally raised an exciting flag for me. You said “indoor raised beds” was one of your preferred ways of growing. Is that exactly what it sounds like? Are you talking about for those who are growing indoors versus outdoors, indoors you’re actually constructing a raised bed that is shared by multiple plants so instead of them being in individual containers, you’ve got a couple different plants that are sharing the same raised bed. They’re roots can intermingle, they can access nutrients at different parts of this larger raised bed, then they grow side by side. Is that what you’re describing?

Tad Hussey: Exactly. It makes growing so much easier. We aim for about a foot to 18 inches in depth for soil on these beds and typically stay about 4 feet in width, then you can build them at any length that allows us to reach into the beds. By putting structures up above the beds, we can then scrog the plant and train it appropriately. The raised beds allow for better and more consistent watering. They allow for those plants to share a mycorrhizael relationship with each other. They make it really, really easy to set up a watering system. For example, the blue mats or drip irrigation.

Shango Los: As soon as you said that, my mind just started running with the implications of it. I think this is going to be my next thing to look into. Why don’t we take a quick little side bar? How would you recommend people go about building an indoor raised bed? What are your preferred materials?

Tad Hussey: Most of this stuff you can just get at Home Depot. If you build them 8 by 4, it’s really easy in terms of the lengths of the lumber. For example, you can make them out of something as simple as plywood and 2 by 4’s, from that you just insulate it with pod liner, put in a couple degree angle on the drain so you have a drain in one corner in case for some reason you happen to over water. That’s really all there is to it.

Shango Los: That’s really cool, right on. Let’s get back to the soil recipe we were talking about in the second segment. The goal of building our own soil is to make sure that the soil itself is alive. It is a good home for microbes, it will make the nutrients be more bio-available to allow for more thriving plants. Will I be feeding the soil over the course of the cycle or is the idea that I’ve built a soil, so I don’t have to do anything to it? Or will I feed it with something in particular?

Tad Hussey: I think the goal here is to really get all the minerals and nutrients into the soil so the plant can select what it wants when it wants it. That being said, sometimes you will find that you may not have amended the soil with enough nutrients in the beginning of your cycle. You will have to add something to make up any deficiencies. Sometimes it’s as simple as top dressing with some earth worm castings if it seems like there is a minor deficiency or you can have on hand an organic bottled nutrient like a grow or a bloom formula, just in case, to help the plant finish it’s life cycle. In addition to that, there are a lot of things people like to add. Silica is a great one because it helps with any micro-toxicities in the leaf surface as well as heat stress. It builds thicker cellular walls so you have a stronger stalk. That’s a really popular addition in the form of potassium silicate, seaweed extract powder will provide plant growth hormones and regulators as well as chelation and some potassium and up to 70 trace elements. There’s a ton of different things you can add. The only limit is your imagination in regards to the different nutrient sources out there.

Shango Los: I see, it’s a lot like so many aspects of cannabis growing where if you build your soil, you’re going to be 80% of the game already locked down. If you want to continue on from that, you can do even better. It’s kind of this sliding scale about how much you want to get into it, how much you want to research and how much you want to spend and spend time finding these materials.

Tad Hussey: Exactly, and here’s where a lot of that wild crafting stuff from the last talk would come in to play. You could definitely top dress your bed with comfrey for example, or apply nettle tea for the silica. One thing to keep in mind that I like to warn people is always start at a quarter strength of what the recommended applications are when you’re applying to a heavily amended soil like what we’ve been talking about. In addition to that, make sure that when you do apply these nutrients, not only are you going light but you’re not applying them homogeneously across your entire growing space. You really can’t tell if a product or an amendment is having an effect on your crop unless you have a control there. I always like to tell people to experiment. Try 2 or 3 slightly different soil recipes and be sure to keep track to how your plants respond to that. You may be growing a particular strain or cultivar that may want slightly more phosphorus or a little bit more potassium. By experimenting with this, you can really dial in your own scene right there in your home.

Shango Los: Right on. I’ve got one more question for you before we wrap up today. You brought this idea of reusing the soil into the discussion, I really like that idea both for the improved nutrient value of the soil over the 2, 3, 4th cycle — but also it just wastes less resources. When you’re keeping the soil outside and you’re giving it a cycle off to breathe, do you need to do this in a covered environment so that it’s not getting wet or is it easy enough to make a big pile out in the elements and let it fend for itself? How do you keep the soil while you’re cycling it or while you’re letting it rest during an off cycle?

Tad Hussey: In a raised bed situation, you’re never even moving the soil out of the facility or out of your room. It’s going to stay right there where it is. If you’re growing in smaller containers and you need to re-pile the soil, re-amend it then move it back in, ideally I don’t think you’re really letting the soil rest. If you had to move it outside, keep in mind that you are potentially exposing it to pathogens and diseases when you bring it back indoors. I would definitely put a tarp over the top because you don’t want to leach out any nutrients that are still preexisting in the soil. Getting back to this reused concept, the one question I get asked the most is how do you deal with pests. For example, if you all of sudden have to deal with spider mites or fungus gnats or root aphids, how do you reuse the soil in situations like this? That would be an entirely new talk but basically I just want to say that I really firmly believe that there are organic solutions for all of these pests and that you can still reuse the soil. We have people locally here doing that, using a combination of predatory insects in various organic IPM strategies. Just because you get a pest doesn’t necessarily mean you still have to check out your soil and start over.

Shango Los: Right on. That’s a really good thing to point out. If you’re a listener and you think that idea of predatory insects is a good idea, feel free to go back to our podcast from about 6 weeks ago with Shane Young of Natural Enemies Bio-control out of Portland and he talks all about how to use beneficial insects. It’s a pretty good show. Tad, thank you so much for joining us on the show again. I’m looking forward to having you back in a couple weeks to talk about compost teas. For anybody who wants to hear more about Tad, you can go back to last months episode where we talk about wild crafting nutrient teas and you can also view Tad’s entire presentation at Canna-Con Seattle from 2 months ago on the video section on Ganjapreneur.com. Tad, thanks for being on the show and we’ll talk to you again in a couple weeks.

Tad Hussey: Sounds great. Thanks Shango.

Shango Los: You can find out more about Tad Hussey and Keep It Simple Organics on their website at KISorganics.com. You can also find some of the materials that Tad talks about sourcing on their website as well. You can find more episodes of the Ganjapreneur podcast in the podcast section at Ganjapreneur.com and in the Apple iTunes store. On the Ganjapreneur.com website you will find the latest cannabis new, product reviews and cannabis jobs updated daily along with transcriptions of this podcast. You can also download the Ganjapreneur.com app in the iTunes store and Google Play. Do you have a company that wants to reach our national audience of cannabis enthusiasts? Email grow@ganjapreneur.com to find out how. Today’s show was produced by Noel Abbott. I am your host Shango Los.