MedMen Enterprises is a well-known brand throughout the cannabis industry. Over the past several years, MedMen has built a massive presence in the industry with more than 30 retail stores and numerous cultivation sites throughout the continental United States. They are also traded publicly on the Canadian Securities Exchange (MMEN) and OTC in the United States (MMNFF).

However, in recent months the company has experienced some turmoil (along with many other major players in the industry), having undergone major layoffs in that time, letting over 200 representatives go. The company is also selling its licenses in Arizona and Illinois and closed a store in Ft. Lauderdale, Florida.

In the past week, rumors of financial distress circulated on social media and various blogs, which seem to correlate with a drop in stock value — and financial outlet MarketWatch confirmed that the company was looking to pay debts with stock. Ganjapreneur also published a story about this revelation earlier today.

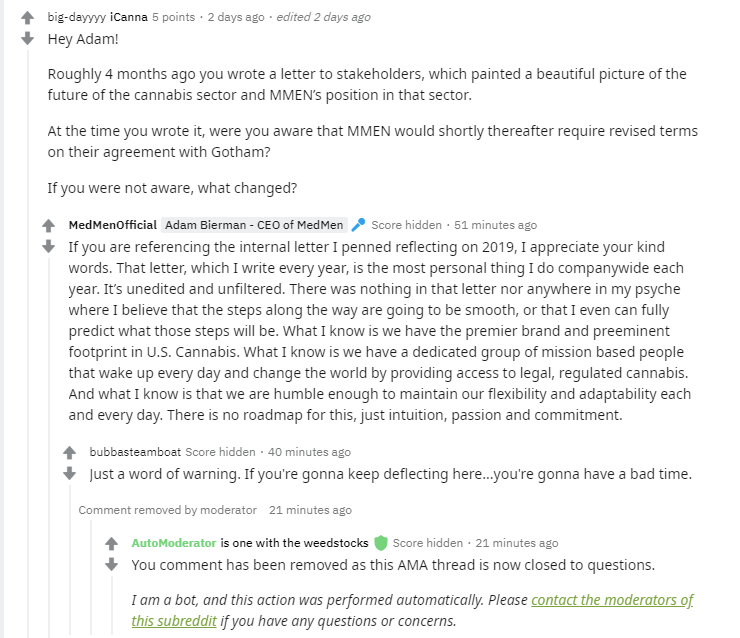

Amid the uncertainty, CEO Adam Bierman announced a Reddit AMA (which stands for “Ask Me Anything”) — a post format used for open-ended interviews from the general public — that took place today. We watched the conversation unfold over the course of approximately an hour, and have compiled the list of questions that Bierman provided answers to below. While he did answer some of the tough questions that were posed, many of the questions remained unanswered, and many commenters expressed frustration that Bierman did not directly address or provide useful insight related to their specific concerns.

Question from Reddit User ACphl:

What is the most difficult part about right sizing the workforce? How have you and your team determined how to downsize without severely impacting operations? What are some important lessons learned as CEO?

Adam Bierman: The most difficult part has been saying goodbye to people in our MedMen family. These people dedicated their lives to inviting the world to discover the remarkable benefits of legal, regulated cannabis. As a result of their dedication we created a platform and environment that is literally changing the way people live their lives, for the better. One of the greatest lessons, for me, has been that transparency to the organization, especially when the content isn’t easy, is an expectation that should be placed on the CEO. I tried to find ways to make this process easier (on both our employees and myself) but in the end the healthiest thing I can do for this organization is to be brutally honest and open.

Reddit User bolognacrony: Hello Adam, I am an associate who has witnessed many lay offs with immediate hiring (10 positions) within a week turn around. This violates union contracts with the state of California employees. There also have been demotions that violate union contracts. (Lead associate to hospitality). My question is why are there positions being created while others who are supposed to be protected within the union are losing their jobs? And how is it legal to fire them and demote them? Also what are you doing to compensate or to change the delivery system to ensure safety since several associates have been robbed at gunpoint?

Adam Bierman: Our employees are MedMen. Our retail employees are why MedMen is “MedMen”. We are proud to be the first national cannabis company to have a partnership with UFCW. We are proud that we compensate our retail employees with union wages. We are very proud that every employee at MedMen has stock options and hence an “interest” in the long term success of what we are building. I completely understand that this restructuring can lead to questions and uncertainty and I commit that I will see us through this and we will come out the other end stronger than ever.

Reddit User valueresponsibility: How and how much do you and partner plan on paying yourselves this year and years to come? You previously took a 1.5M salary to go with paying yourselves a massive 4M each in bonuses. You have since then reduced your salary to $50,000 and to the best of my knowledge haven’t received another bonus. Both numbers aren’t realistic or considered the “norm” for people in your position. When things do start to “improve” how much and how quickly will that affect your compensation?

Brendan Kennedy (TLRY) – $425,000

Nic Neufeld (APHA) – $513,000

Bruce Linton (CGC) – $200,000

It doesn’t sit well with investors seeing you and your partner buying 11 million dollar Beverly Hill homes next to Leo DiCaprio while the rest of us are taking huge losses. Some of us owning shares that currently sit at 1/10 the price we paid. The expectation is that if we suffer then you suffer with us. If you were going to pay yourself a bonus then you should have paid us dividends as well. Otherwise, that money could have been reinvested into growing the share price. While I’m still invested in Medmen my biggest fear isn’t the company itself but you as a CEO.

– A frustrated investor.

Adam Bierman: I empathize and completely understand where your frustration is coming from. While 2018 was this incredible year for the stock, 2019 was a disaster. While the stock underperformed, we opened 17 new stores including 4 in CA and 2 in Illinois (which in January flipped to rec). As of now I take a 50k salary and while I can’t give you advice on whether you should buy, hold or sell MedMen stock I can, however, tell you what I have done personally. I have personally never sold a single share of MedMen stock. I have bought the stock. And this has been publicly disclosed. I bought 1,550,387 shares this month for about $660,000. I also bought 342,660 shares in the public markets in December 2018 for a million dollars. I am all in on this company and its future. And coming out the other end of this restructuring our future has never been brighter.

Reddit User MMJInvesting: Will you step aside and relinquish control of your company so fresh eyes and forward looking vision can try and turn things around? Obviously complancey and sheer lack of respect for shareholders has got MedMen where it is today

Adam Bierman: As the biggest shareholders Andrew and I will always do what’s in the long term best interest of the business. In December, Andrew proxied his supervotes to Wicklow Capital and Ben Rose, our Executive Chairman. He also stepped away from the President role and moved to Chief Brand Officer. We have never been shy about having the right people in the right role and even more importantly the best person available for the role at that time. I know that for today I appreciate the support of our outstanding executive leadership team, board and capital partners (Wicklow and Gotham). I will continue to work tirelessly to create as much long term equity value as possible, for as long as I am CEO.

Reddit User Khalifaf*ck: Hello Adam, you about to walk through some fire during this AMA. But I hope you man up and actually answer the questions with respect to all that hold shares in your company.

-

GGP is currently bag holding large notes that were given to them as part of the credit facility. I want to hear your opinion of that working relationship and what GGP might be thinking when they see what the stock is currently trading at. I mean, you said in your latest interview that you are well positioned and that is why Wicklow and GGP are still involved, but I want to know what “well positioned” looks like. What’s the vision, what are the stats, what are THEY seeing that investor’s aren’t!!

-

Based on the Florida OMMU weekly data, MedMen looks to be struggling to sell product. Can you please provide some insight of what you are doing to improve sales? When is the cultivation expansion going to be complete?

-

MedMen spent hundreds of thousand of dollars on sponsoring the Florida legalization ballot initiative. Now that it’s dead, do you think MedMen pushed too hard in getting Florida stores online? How has your vision changed for Florida?

-

Let’s fast forward to 2022, what does the current financing situation look like for MedMen? Has GGP converted shares? Did Wicklow run for the door when the share price allowed it?

-

In your opinion, what year would be “the year” for MedMen?

Adam Bierman: We have been doing this for 10 years now. We have never looked at this through any short-term lens. This is the generation that will end prohibition. In conjunction with that, as the premier brand and only distinct national retailer we will reap financial rewards. We invite you to continue to play the long game with us. We believe there will be amazing years for our stock, 2018, and hopefully less brutal ones, 2019, but in the end our stock will be valued based on all the value we create and continue to unlock.

Reddit User lh7884: Hi Adam, what do you think is holding back the company the most right now and what is being done to fix it? Also what are your thoughts on Federal legalization and also the States Act and how would either of those benefit the company going forward. Finally where do you see MedMen 5 years from now?

Adam Bierman: We built an irreplaceable retail cannabis footprint. We spent money to do it. We built a state-of-the-art customer loyalty and delivery platform. We spent money to do it. Retail licenses block future market entrance due to setbacks. No amount of money could secure the locations we have today. And we believe they are special locations. The information we derive from our technology platform will give us a competitive advantage. We will know what customers want and where and when they want it.

Future dividends from both will be significant. They will justify the cost. I do not, personally, believe the market appreciates the value of these achievements. Or, if the market understands the value, there is a question around whether we will be around long enough as a company to enjoy the fruits. If we had continued doing business in the same way the stock market might have ended up being right. But we evolved. And we are continuing to evolve and adapt to the new market reality. We have significantly cut costs, reduced corporate headcount, and are turning every stone to reduce costs and conserve capital. I regret not implementing this cost cutting sooner. We have now made the necessary adjustments and are poised to thrive.

Reddit User RealWorlofWeedSt: Hi Adam- With regards to paying vendors, it would be nice if you could put to rest the “rumors” circulating that they are getting notices to settle .50 on the $1. What hasn’t come out yet is MedMen signing for product and canceling checks or offers to settle debt with stock. Can you put those last two items to rest before they start? On point 1 with regards to vendors, there’s already documentation from some of your own people that payments might not be made until March. If that happens and continues, why will vendors continue to stock MedMen shelves with product. Here’s a link to the email from Ben Shultz payments.

As for Bankruptcy I’ll put that to bed for you. People harp on a bankruptcy portion of texts received, but most know that is not a viable option as companies in the cannabis space are not afforded bankruptcy protection because that’s a federal protection & cannabis is federally illegal. Receivership is in the table in California, see $dyme as a reference. Good day

Adam Bierman: Through this restructuring we are fastidiously managing our cash position and we are working with our vendor partners on our existing AP and how most efficiently to pay those obligations. This is to be expected for a retailer in a restructuring but that doesn’t make it any easier. Many of these vendors are personal friends. Many of these vendors, specifically in CA, rely heavily upon MedMen for their businesses. We are being as communicative and partner like as possible given the reality.

I will say I appreciate your question as well as your influence and I have no idea what I did to anger you in your past life but I’m extending an invitation to meet you on Weed Street and smoke a joint and put it behind us.

After about an hour of answering questions posed by investors, former employees, and interested industry professionals, Bierman posted the following:

“That’s all the time I have for now. WOW. No more roller coasters for me. I’ll just do this again when I want an adrenaline rush. Thanks again for all your questions. To a prosperous 2020 and continued progress towards the end of prohibition. Because a world where cannabis is legal and regulated is safer, healthier and happier.”

While the AMA seemed originally like a brave tactic to address rampant rumors of bankruptcy and flailing stock prices, the fact that Bierman avoided numerous poignant questions and seemed to deflect on the questions that he did respond to may not do much to quell the speculation about MedMen’s future. At the time of writing this article, $MMEN stock is currently down 4% for the day on the CNSX and 6% for the day on OTC.

Get daily cannabis business news updates. Subscribe

End